In the rapidly changing world of cryptocurrency trading, where the choice of exchange can significantly impact trading strategies, a clear trend is emerging among XRP whales. These large-scale investors seem to favor U.S. exchanges over offshore venues, driven by a combination of regulatory clarity, market liquidity, and security concerns.

Regulatory Clarity and Stability

One key reason XRP whales prefer U.S. exchanges is the comparative regulatory clarity in the United States. After years of uncertainty, the legal landscape for XRP has begun to stabilize, particularly following the recent legal battle between Ripple and the U.S. Securities and Exchange Commission. The partial victories Ripple has secured have created a more predictable environment for trading XRP within the U.S. For whales, ensuring that large transactions are not unexpectedly impacted by legal changes is crucial, making this regulatory clarity essential.

In contrast, many offshore exchanges operate in countries with lighter regulations. While this can offer the advantage of fewer restrictions, it also introduces the risk of sudden changes in trading conditions or government intervention—both of which are highly unfavorable for whales managing substantial portfolios.

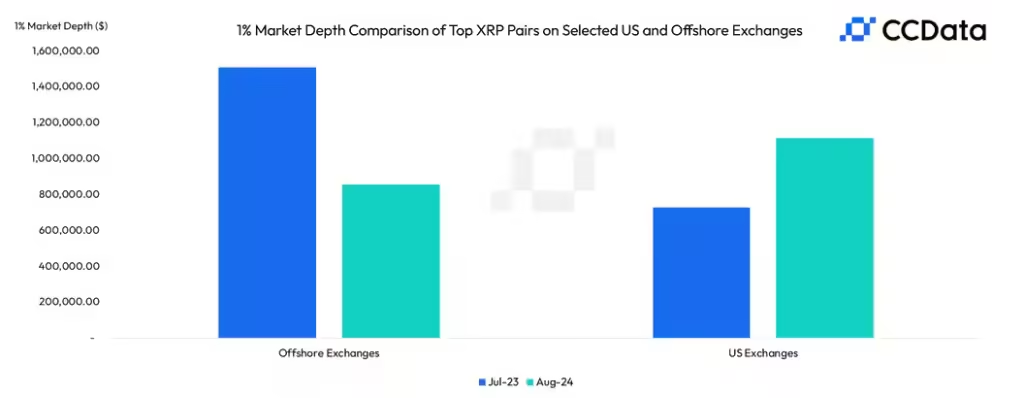

Market Liquidity and Depth

Another critical factor is the liquidity of the markets. U.S. exchanges generally offer higher liquidity and market depth for XRP trading compared to most offshore platforms. This liquidity is vital for whales who need to execute large trades without causing significant price fluctuations. The ability to enter and exit positions smoothly is a significant advantage provided by U.S. exchanges.

Although offshore exchanges might offer tempting incentives such as lower fees or higher leverage, they often lack the liquidity needed by large XRP holders. Whales are willing to pay the higher costs associated with U.S.-based exchanges because they know they can execute large volumes with less price slippage.

Advanced Safety Features

Security is another crucial consideration. U.S. exchanges are typically subject to stricter regulations regarding the protection of customers’ assets. This often includes mandatory insurance coverage, enhanced cybersecurity measures, and increased transparency in operations. For whales, knowing that their assets are safeguarded by these enhanced security measures is invaluable.

On the other hand, offshore venues, while potentially more flexible, come with higher risks. Looser enforcement and possibly lower security standards make these platforms more vulnerable to hacks or fraudulent activities. Given the substantial amounts of XRP that whales typically hold, they are more likely to prioritize security over the potentially higher returns offered by offshore venues.

Conclusion

The preference of XRP whales for U.S. exchanges over offshore venues is driven by a combination of regulatory stability, market liquidity, and superior security measures. As the cryptocurrency market continues to evolve, these factors are likely to remain central to the decision-making process for high-stakes investors. For XRP whales, the advantages of trading on U.S.-based platforms far outweigh the potential benefits offered by offshore exchanges, creating a more secure and predictable trading environment.